Weekly Market Commentary 02.13.2023

The Markets

This time may be different...or it may not be.

There has been a lot of speculation about how the Federal Reserve’s policies will affect the United States economy. Economists have differing opinions about whether the country is headed for:

- A recession, which occurs when the economy stops growing and begins to contract; or

- A soft landing, which occurs when economic growth slows but does not decline.

It’s an important question because recessions often are accompanied by layoffs, rising unemployment rates, dwindling investor confidence, lower consumer spending, and stock market downturns.

Recently, a new theory bubbled up.

The United States may be experiencing rolling recessions, reported Rich Miller of Bloomberg. “Now there’s a new economic meme making the rounds. It’s called a rolling recession, and it’s a bit of a hybrid. One industry suffers a contraction, then another, but the economy as a whole never swoons, and the job market largely holds up…That framework doesn’t explain everything that’s going on with this puzzling post-pandemic economy, but it’s as good a description as any of what the U.S. has been going through since the Federal Reserve began lifting interest rates from zero in March of last year.”

Uncertainty around current economic conditions has a lot to do with the pandemic, according to Schwab’s chief investment strategist Liz Ann Sonders whose talk at the January National Retail Federation (NRF) conference was reported on by Fiona Soltes for the National Retail Federation. When lockdowns ended, demand for goods lifted prices and helped push inflation higher. When services became available again, demand shifted and we saw “pockets of weakness in many categories on the goods side, certainly in housing, that are definitely in recession territory.”

If rolling recessions don’t meld into a national recession, we could see continued economic expansion as inflation moves lower. It’s also possible we could see economic growth heat up and inflation remain at higher levels than we’ve become accustomed to having. It’s just too early to tell.

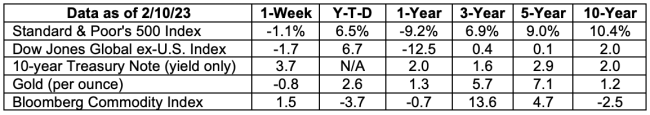

Major U.S. stock indices moved lower last week, reported Teresa Rivas of Barron’s. Treasury yields rose across maturities last week as economic data and Fed officials suggested that further rate hikes may be ahead.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Asset or liability?

When companies total up assets and liabilities for accounting purposes, employees aren’t counted as assets. It’s a peculiarity that has significant repercussions and the potential to negatively affect both employees and shareholders, suggested Wharton professor Peter Cappelli in the Harvard Business Review.

“Many common practices for managing employees are hard to explain,” he wrote. “Why do companies obsess over cost per hire but spend so little time trying to see if they make good hires? Why do they provide so little training when we know it improves performance and many candidates say they’d take a pay cut to get it? Why do firms delay filling vacancies and let work go undone? Why do they spend so much money leasing personnel from vendors rather than hiring their own?”

Cappelli contends the problem is rooted in the standards set by the Financial Standards Accounting Board (FSAB) in the United States. While many companies assert that employees are their most significant competitive advantage, that belief is not reflected in generally accepted accounting principles for publicly traded companies. FSAB-established standards don’t count spending on employees – such as wages, salaries, training and development, and benefits – as investments. Instead, those expenditures are treated as expenses and liabilities.

“…accounting rules say that items with value are assets—but only if they’re owned by the company. On that basis, employees are not considered assets—even though the tenure of a valuable employee is often far longer than the life of any piece of capital equipment. Even when a company buys other businesses to get access to their skilled employees, the acquisition of talent cannot be treated as an investment.”

Under current accounting standards, layoffs are one way for employers to rapidly lower costs and make balance sheets look more attractive. The loss of knowledge, skills, and abilities that accompanies layoffs doesn’t factor into financial accounting, even though it may negatively affect company productivity.

While accounting standards have yet to change, companies’ thinking may be. In a Bloomberg opinion titled, ‘U.S. Companies Aren’t Firing People As They Usually Do’, Kathryn A. Edwards wrote, “…the trade-off between short-term cost-cutting and human capital appears to [be] changing as qualified workers become harder to find and hire.”

Weekly Focus – Think About It

“Everyone talks about building a relationship with your customer. I think you build one with your employees first.” —Angela Ahrendts, businessperson

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.investopedia.com/terms/h/hardlanding.asp

https://www.investopedia.com/terms/r/recession.asp

https://www.bloomberg.com/news/articles/2023-02-09/what-is-a-rolling-recession-us-could-escape-economic-pain?cmpid=BBD020923_NEF&utm_medium=email&utm_source=newsletter&utm_term=230209&utm_campaign=nef (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/02-13-23_Businessweek_Forget%20Hard%20or%20Soft%20Landing_3.pdf)

https://nrf.com/blog/charles-schwab-chief-investment-strategist-talks-rolling-recession

https://www.barrons.com/articles/stock-market-has-worst-week-of-2023-no-news-is-bad-news-ed6cc72c?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/02-13-23_Barrons_The%20Stock%20Market%20Just%20Had%20Its%20Worst%20Week%20of%20the%20Year_5.pdf)

https://www.cnbc.com/2023/02/10/us-treasury-yields-investors-await-data-fed-speaker-remarks.html

https://hbr.org/2023/01/how-financial-accounting-screws-up-hr (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/02-13-23_HBR_How%20Financial%20Accounting%20Screws%20Up%20HR_7.pdf)

https://www.bloomberg.com/opinion/articles/2023-02-08/us-companies-aren-t-firing-people-as-they-usually-do (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/02-13-23_Bloomberg_US%20Companies%20Arent%20Firing%20As%20They%20Usually%20Do_8.pdf)