Rethinking Multi-Factor Investing: Is Smart Beta Smart?

I remember when multi-factor strategies became popular 15 years ago. They were marketed to add more diversification than the market while capturing the known risk premia – value, momentum, quality, volatility, and size – and were considered “smart beta.”

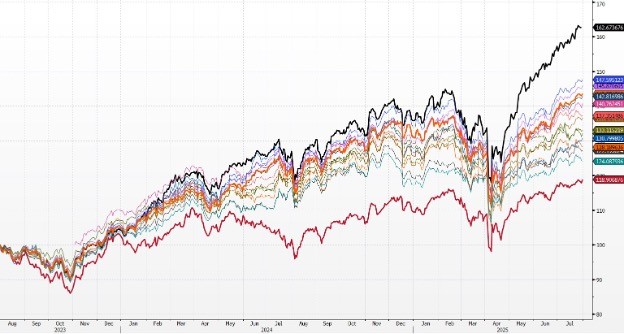

I spoke with two advisors the other day that said they moved away from these strategies as some have been significantly underperforming the market. The chart below supports this view.

Various Multi-Factor Strategies (8/1/23 to 7/31/25)

The names and tickers above have been removed to protect their identities. Very few of those displayed have kept up with the S&P 500 (bold orange line) over the last two years. One strategy (bold red line) has underperformed by a whopping 25%. We believe this is unacceptable to investors and mischaracterizes the value that multi-factor investing can bring.

We believe it’s possible to have a multi-factor approach without being overly concentrated in positions, sectors, or styles, but also letting the factors that are working well to perform. We believe it’s possible to have return enhancement and risk mitigation at the same time. The bold black line illustrates that this is possible.

We also believe that the process doesn’t have to be an enhanced index approach. It can be supportive of active management. Yes, in a 60-stock portfolio, there will be some idiosyncratic risks, but that doesn’t negate the quantitative-driven bottom-up process. When trend is integrated as a factor with value, momentum, volatility, and quality, we believe that can also enhance returns while simultaneously reducing risk. This is because trend takes on many forms – reversals (value, mean reversion, momentum), stable trends (low volatility), and breakouts (momentum). Ideally, most positions in the portfolio will have 2 or more factor universes that they belong to.

I believe we have a distinct approach that brings the elements and discipline of active management, quantitative investing, and trend-following all together and without needing to hold 200-400 securities, like some multi-factor strategies do. Risk is managed by sector and factor constraints but also by position sizing.

There are different thoughts on position sizing. Some suggest limiting the position size to the volatility of the position, which makes a lot of sense if the primary goal is risk management. Others believe that you should let your winners run as far as possible while systematically cutting losers. This works if your goal is to have the highest possible performance, without concern for concentration and risk.

We believe a balanced approach makes sense. It can allow for competitive returns while managing risk. Limiting positions to 1-2% of the portfolio and regular rebalancing allows for less concentration than the market, that now has position sizes of 8%, 7%, 6%, and 4%, respectively, for the four largest positions.

We have no issues with the 1.0 versions of multi-factor or “smart beta,” but we believe we can be smarter. It’s time to unshackle the quants to look at multi-factor investing in a newer, more actively managed light that includes trend, allows factors to float some (factor momentum), and that doesn’t require 200-400 stocks.

Disclosures & Important Information

The S&P 500 is a market capitalization-weighted index that tracks the performance of 500 of the largest publicly traded companies in the United States.

Securities offered through LPL Financial, Member FINRA/SIPC. LPL Tracking Number: 771950. Investment advice offered through WCG Wealth Advisors, LLC, an SEC registered investment advisor. WCG Wealth Advisors, LLC and The Wealth Consulting Group are separate entities from LPL Financial.

These views are those of the author, not of the broker-dealer or its affiliates. This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. All investments involve risk, including loss of principal. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.

Government bonds are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. You cannot invest directly in an index. Consult your financial professional before making any investment decision.